A tradition returns to TGCTS as we welcome the Canadian Taxpayers Federation for Episode 36!

Part 1- Gage Haubrich, CTF Prairie Director, starts off by tackling the City of Winnipeg budget. We dig into the under-the-radar subject of the $200M civic 40-Year Bond, and the interest cost to taxpayers.

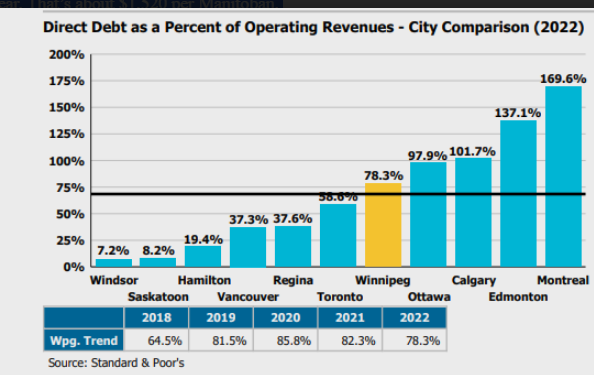

Despite the city carrying a higher than Canadian average debt load, somehow $82,000 of support for residential services like Happyland Park pool just didn’t fit council’s “urban vision”.

Gaubrich urges all taxpayers to tell their councilor they “want the government to focus on basic priorities: recreational pools, roads, keeping the streets clean and safe” not spending on travel to conferences, adding bureaucrats, or exorbitant severance pay to outgoing ward assistants.

It’s an uphill fight since special interest lobby groups often get government funding to advance their narrow goals.

- You can support our interviews and analysis by contributing via PayPal or Interac, or arrange by emailing us! Email [email protected]

- Join us on Facebook

17:38 Part 2- Wab Kinew’s new budget flaunted a huge $1.4B increase in spending and falling revenues, but WFP columnist Devryn Ross called out the Finance Minister for trying to cover it up.

The Tories had set aside half a billion for new civil service contracts, and Adrian Sala lied to try and explain away the deficit. That’s not the only lie connected to the NDP approach to the budget.

While the 14 cent a litre tax break “helps a lot of people out”, an $800M deficit and billions wasted on interest payments- $1520 per Manitoban – trends our province in a dangerous direction.

Haurich addresses the change in the education tax credit to a flat $1500, contrary to Kinew’s election promise to keep the discount at 50% of the bill. We walk through the escalating net cost to homeowners as the NDP farm club on school boards ratchet up taxes.

While Tom Brodbeck claimed “it’s a good thing” for Kinew to break that election promise, Gaubrich says “they shouldn’t have promised it in the first place… that’s a big problem that contributes to cynicism and hurts taxpayers’ walletbooks.”

Marty Gold raises the way governments are chipping away at the intergeneration transfer of wealth within the working and middle class while delivering less value for dollar to taxpayers.

Corporate welfare such as E-car rebates, millions allotted for a safe injection site that Kinew’s crew won’t be living anywhere near, Nahanni Fontaine jetting an entourage to the United Nations, are part of the expensive priority of the NDP- feeding their base, and claim the budget will be balanced in 4 years in time of the next election.

In the meantime, Manitobans will be paying $9.6B in interest over that term.

In the overall scheme of things, providing a paltry $300 credit for property security systems- which can save millions in losses, insurance hikes, and policing costs- shows it’s difficult to get a caucus with no experience in making a payroll “to understand the plight of the everyday taxpayer, when your paycheque has been coming from the government,” concludes Haubrich.

40:00 Part 3- A fast wrap up, and pitch for last-minute support as the final contributions to the winter funding drive are being collected up this week. We earn your support!

- All our episodes with full descriptions and photos, are at ActionLine.ca

- Links to our best podcasts by category, are on the Donate page

- Important Columns and Articles on the Blog tab – Just added- https://actionline.ca/2024/04/a-quiz-about-israel-and-hamas-for-politicians-pundits-and-protesters/